[ad_1]

In early December 2024, American Airlines and Citi announced an extension of their decades-long partnership, including a promise to go exclusive when it comes to credit cards.

For years, American Airlines has offered co-branded AAdvantage credit cards from two different banks: Citi and Barclays. That unusual arrangement dates back to the 2013 merger of American Airlines with US Airways. Barclays was the issuer of US Airways’ cards, while Citi issued them for American Airlines. After the merger, both issuers retained a portion of the combined airlines’ credit card portfolio.

But in its December announcement, Citi noted it will acquire Barclays’ suite of AAdvantage cards, becoming the exclusive issuer for American Airlines and aiming to move existing Barclays cardholders over to Citi products sometime in 2026. Citi and American have both teased new benefits for flyers, but beyond that, the companies have been short on specifics, noting that more details would eventually follow.

I grew up near a major American Airlines hub and have been an AAdvantage member since 1998. While I don’t have any major complaints about flying American, its credit cards and perks for frequent flyers have been outpaced by competitors in recent years, which gives me little incentive to choose an American flight over Delta, United or Southwest. Ideally, Citi and American will take this opportunity to overhaul these credit cards and make the program a little more competitive for flyers — starting by, at long last, allowing the transfer of Citi ThankYou points to American Airlines miles.

What’s staying the same, for now

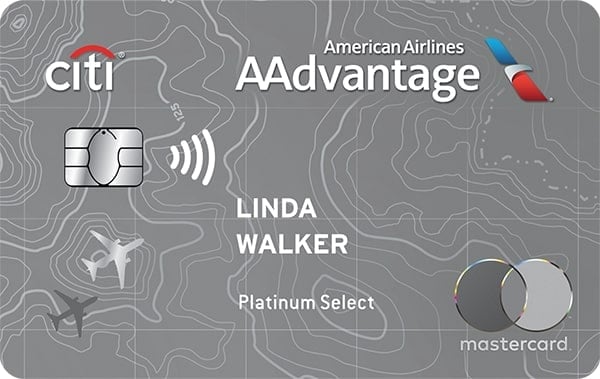

Currently, multiple AAdvantage cards remain on the market, including two of the best-known American Airlines consumer cards:

The two cards have similar annual fees, and in terms of ongoing rewards on American Airlines spending, they’re identical. Both offer perks like early boarding, a checked-bag waiver, and a percentage discount on qualifying in-flight purchases with American.

However, they differ in some significant ways, including their sign-up bonuses and side benefits.

Annual fee

$0 intro for the first year, then $99.

Sign-up bonus

Earn 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

Earn 60,000 AAdvantage® bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days.

Rewards

• 2 AAdvantage miles for every $1 spent at gas stations and restaurants.

• 2 miles for every $1 spent on eligible American Airlines purchases.

• 1 mile per dollar spent on all other purchases.

• 2 AAdvantage miles for every $1 spent on eligible American Airlines purchases.

• 1 mile for every $1 spent on all other purchases.

Additional benefits

• Priority boarding and first checked bag free for cardholder and up to 4 traveling companions on your reservation.

• $125 annual American Airlines flight discount after you spend $20,000.

• 25% discount on in-flight food and beverage purchases.

• Priority boarding and first checked bag free for cardholder and up to 4 traveling companions on your reservation.

• Annual companion certificate for $99 (plus taxes and fees) after you spend $20,000.

• 25% discount on in-flight food and beverage purchases.

• Up to $25 back as a statement credit per year for in-flight Wi-Fi purchases.

Barclays has no immediate plan to pull the AAdvantage® Aviator® Red World Elite Mastercard® from the market until the acquisition date is a little closer. But given the similarities to the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, it seems unlikely that the AAdvantage Aviator cards would continue to be available to new cardholders once Citi acquires Barclays’ portfolio.

As for existing holders of the AAdvantage® Aviator® Red World Elite Mastercard®, they can keep using their cards as normal for now, but major changes will be on the horizon for them, likely including an entirely new card. Citi noted in its news release that it “will begin transitioning [Barclays] cardmembers to the Citi portfolio in 2026,” although it’s unclear what replacement product those customers would get.

Credit card changes I’d like to see

Compared with other airline cards, Citi’s American Airlines cards are, well, kinda boring. Sure, you get a free checked bag and can board early, but those are pretty standard benefits. I hope this partnership inspires Citi to add some interesting new perks to their cards.

1. Will we finally be able to transfer Citi ThankYou points to American?

Out of all the travel rewards I’ve accrued, I’m most protective of my American Airlines miles and least likely to use them on a whim. This is partly because I earned a lot of those miles the hard way — actually flying. But it’s mostly because they’re not exactly a renewable resource. I can’t earn as many American sign-up bonuses as, say, Chase bonuses, and ongoing rewards for spending on American Airlines cards are significantly lower than I’d earn by using my Chase Sapphire Preferred® Card or Capital One Venture Rewards Credit Card.

And unlike the airline’s competitors, you can’t transfer any proprietary credit card points to American. Delta, United, Southwest, JetBlue, Alaska and Hawaiian Airlines all partner with at least one credit card issuer, allowing certain cardholders to transfer rewards to the airline’s loyalty program. Why doesn’t American?

Yes, there are some workarounds: You can transfer Marriott Bonvoy points to American (at a truly awful transfer rate). I normally transfer credit card points from Chase, AmEx or Capital One to British Airways and then book a domestic American Airlines flights using Avios. But it’s inconvenient and a hassle if you need to change your flight.

In the past, certain Citi cardholders and Bilt cardholders could transfer points to American, but neither partnership proved to be permanent. If Citi could snag a long-term deal allowing cardholders to transfer its proprietary ThankYou points to American, it would be a big win for flyers and a huge boost for the recently revamped Citi Strata Premier℠ Card. I’d personally apply for that card as soon as possible.

2. Would Citi adopt Barclays’ unique sign-up bonus?

The sign-up bonus on the AAdvantage® Aviator® Red World Elite Mastercard® is one of the easiest you can get, because any kind of purchase will trigger it, no minimum required, beyond the annual fee: Earn 60,000 AAdvantage® bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days. It’s valuable, too. NerdWallet estimates that these points could be worth $960. It’s rare to find a sign-up bonus that can get you several round-trip flights just for making a single purchase. Citi’s American Airlines cards, along with cards from competitive airlines, normally require you to spend thousands of dollars to get that kind of sign-up bonus.

3. Or perhaps offer a companion pass, as Barclays’ Aviator Red does?

Citi could also choose to give holders of its consumer cards the opportunity to earn a companion pass through spending, similar to Southwest’s co-branded cards. To get that airline’s companion pass, flyers need to take 100 qualifying Southwest flights or earn 135,000 points in a year. But credit card spending and sign-up bonuses on Southwest cards will count toward this number.

If Citi were to offer a companion pass on its consumer cards, it would probably look more similar to the existing perks on the AAdvantage® Aviator® Red World Elite Mastercard® and the CitiBusiness® / AAdvantage® Platinum Select® Mastercard®, which both require a significant amount of spending in a year to earn the pass ($20,000 and $30,000, respectively). It’s much harder to earn a companion pass with these cards, but hey, at least it’s an option for heavy spenders.

4. Discounts on reward redemptions?

Delta and United cardholders both have access to cheaper rewards flights. Delta cardholders get an automatic 15% discount, while United cardholders get cheaper rates on certain flights. A similar perk would be a big win for American flyers.

5. Resurrect million miler spending for cardholders?

American Airlines gives lifetime status to anyone who earns 1 million miles. Years ago, cardholders could spend their way toward this achievement. Bringing this back would be a welcome perk for loyalists who won’t fly enough in the foreseeable future to earn lifetime status the traditional way.

American stopped including cardholder spending toward the million miler program in 2011, but it’s not impossible that the airline could bring it back. Between May and December 2020, spending on American Airlines cards counted toward the million miler program.

The information related to the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® has been collected by NerdWallet and has not been reviewed or provided by the issuer or provider of this product or service.

[ad_2]

Source link